Investors and brands across the retail landscape put their point on what are the crucial factors of investments.

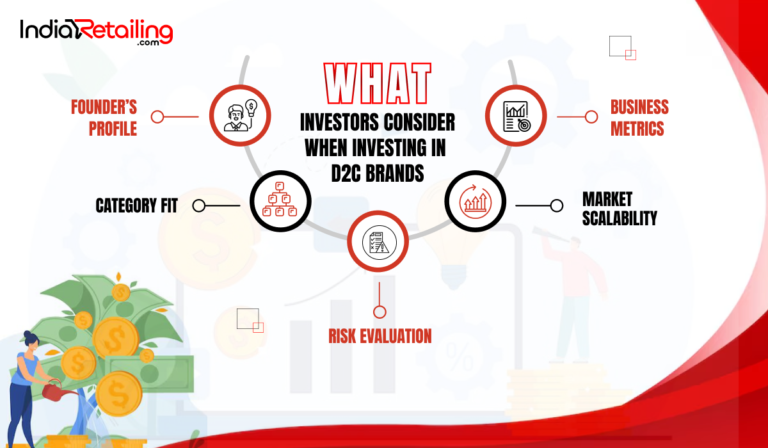

New Delhi: Founders, the category a brand operates in, the market for the product, and revenue growth are key considerations when investing in D2C brands, leading investors told IndiaRetialing.

“When investing in D2C, 50% of my decision is based on the founders: their resilience, why they’ll push through tough times, and their unique right to win, whether it is their background, product, branding, early traction, or customer love. Next, 20% is about market potential: How big can it grow post-investment? Can it scale 5x or 10x,” said Arjun Vaidya, co-founder, of V3 Ventures.

The 2022-incepted company, backed by Belgium-based Venture Capital firm Verlinvest, is a global, founder-led venture strategy investing in consumer brands, technology, and platforms. They typically invest $1-5 million in pre-Series A and Series A rounds, per the company’s LinkedIn profile details.

V3 Ventures has invested in consumer brands like Katkin, Cuure, Yepoda, Wild, Holy and GoZero among others. In addition, it has also invested in enablers and consumer tech brands.

“Some industries may be great for the founder but not large enough for investors. Lastly, 30% focus is on business economics and the team: Revenue, margins, growth rate, repeat customers, and whether there is a solid team beyond the founder,” he added.

The sentiments of Vaidya and many other investors have already been validated by the three seasons of Shark Tank India. Investors pin great emphasis particularly on the profile of founders their background in the business and their appetite to take calculated risks, as was evident in all three seasons of the television reality show Shark Tank India.

According to IndiaRetailing Insights, in the last two quarters which is quarter 1 (Q1) of financial year (FY) 2024-25 and Q4 of FY 2023-24, an amount of over Rs 2,000 crore was raised in the retail industry.

And with angel tax getting abolished in the latest union budget, the investments are likely to increase. Angel tax is the tax the government imposes on funding raised by unlisted companies, or startups if their valuation exceeds the company’s fair market value. The step by the government will foster a robust startup ecosystem that encourages more private investment, as per various experts.

Deep Bajaj, co-founder, of Sirona Hygiene and an Angel Investor in over 40 start-ups has also echoed Vaidya in one of his recent blog posts.“When investing in D2C brands, I focus on The founder, the market, and my risk tolerance. First, the founder’s commitment and drive are crucial—are they fully invested in their idea, with skin in the game?” Bajaj wrote.

“Second, the market—how big is the opportunity, and what’s their competitive edge? Finally, I assess my own risk—investing in industries I understand and spreading my investments wisely. If the founder is strong, the rest can follow,” he added. While some investors consider founders, others like Mumbai-based Prath Ventures predominantly evaluate the category.

“Category selection is key for us. We evaluate the market size, competitive landscape, and growth potential. In D2C, the ability to differentiate through brand positioning and omnichannel strategies is crucial to stand out and succeed,” explained Piyush Goenka from Prath Ventures.

Prath Ventures looks for categories with growth potential, founders with a clear vision, and the ability to navigate challenges, according to cofounder Harmanpreet Singh.

“In D2C, agility and understanding consumer behaviour are critical. A strong founder can scale a business, but aligning the right product with market trends is equally important,” Singh said.

The brand perspective

Brands that have successfully raised funds consistently generally develop a fair idea of what investors are mainly looking for.

“Investors often prioritize the founder’s passion and vision over the business idea itself. They want to see clear commitment, a deep understanding of the market, and the ability to navigate challenges,” said Ridhi Sharma, founder, of BabyOrgano, a Gujarat-based ayurvedic baby care health and wellness brand. “The quality of the product and its potential in the long-term play a crucial role, but it’s the founder’s drive and clarity that often make the difference.”

For Bengaluru-based fashion brand Snitch, Scalability is critical, the company leaders believe that investors need to see how the business can grow exponentially and expand into new markets.

Differentiation is key in a saturated market—having a unique proposition that resonates with your target audience sets you apart,” said Chetan Siyal, chief marketing officer (CMO), at Snitch. “Finally, VCs invest in people as much as they do in businesses. If they see resilience and adaptability in the founding team, they’re more inclined to invest.”

The Bengaluru-based D2C brand was also featured in the second season of Shark Tank and raised an amount of Rs 110 crore last year from SWC Global, IvyCap Ventures and others.